The onset of the Covid-19 pandemic hit the aviation industry on the crest of a decade-long wave of growth. While the impact of the pandemic on aviation, aviation finance and investments cannot be understated, some of its consequences were in the making well before patient zero’s first cough in Wuhan, says Viktor Berta, ACC Aviation’s VP of Aviation Finance Advisory.

The lead-up to the downturn

Passenger numbers, scheduled flights, aircraft deliveries, aircraft trading activity and aircraft values were all on the rise following the industry’s recovery post the 2009 correction. Deal margins had been thinning for years on the back of strong appetites for aviation assets, a level of investor demand that often saw RFPs on popular aircraft types receive 50+ bids. Strong capital markets demand for aircraft Asset Backed Security (ABS) bonds and a wealth of bank debt availability had inflated the market; some would argue to a level which was unsustainable.

Even before the pandemic, lessors and appraisers alike had begun to reassess several of the underlying assumptions driving their pricing models. Several increasingly visible factors, such as the size and timing of forward orderbooks, new deliveries, and the expected return of the 737MAX, made it hard to see older generation mid-life aircraft sustaining values at the then existing levels for long. Certainly, the cracks were already starting to show in certain older generation mid-life widebody aircraft types well before the pandemic started.

The (un)expected correction

Last March, at the ISTAT Americas conference in Austin, those who braved early signs that the virus was growing into a real issue were discussing investment and financing opportunities. There was a seemingly general view that the effects of the virus should become no more than a temporary and geographically contained disruption and shouldn’t seriously impact investment decisions.

Within a couple of weeks, as the global community introduced increasingly stricter travel restrictions, with several countries and entire regions going into lockdown, it became obvious that the issue was bigger than imagined and the effects of the virus were to be reckoned with by airlines, lessors, and lenders alike.

It came as no surprise that the subsequent sudden halt in aviation activity made investors and financiers reassess their exposures and assumptions. Within the next 6 months an incredible amount of pre-covid conventional wisdom has been proven wrong as cash flows and balance sheets of all involved faced the reality of a world temporarily without aviation.

The realignment

The high Loan To Value (LTV), low margin days were over for banks, as were the above-Current Market Value (CMV) bidding on aircraft Sale and Leaseback (SLB)’s for lessors and investors. The unfolding repositioning saw most banks halt origination with some mature incumbents making the decision to completely withdraw from aviation finance. As the market moved from Covid-wave to Covid-wave, existing leases and the attached loans defaulted, temporary payment holidays were put in place then extended again and again.

Airlines, lessors, and banks were faced with a need to restructure large numbers of their financing and leasing arrangements, which were no longer sustainable under Covid-19 market conditions. Older generation aircraft with huge global supply, most of it now grounded for the better half of a year, saw their values plummet sending a large array of loans underwater. With the arrival of the second and third wave it became increasingly obvious that values on these vintages and types would never recover.

As the crisis continued to unfold, the appraiser community took on the herculean task of assessing and reassessing the market realities and adjusting their valuations and projections accordingly.

American flag carriers, European LCC’s and other global tier 1 operators managed to raise fresh capital financing their unencumbered assets through mortgage loans and SLB transactions; while opportunistic lessors and investors started looking at ways to benefit from pandemics impact on aviation, buying aircraft at discounted price levels and increasing lease factors on SLB transactions (from pre-pandemic levels).

Bankers and airlines engaged in negotiation regarding their financing agreements looking for ways to restructure some of the loans to maximize the chances of the airlines’ re-emergence post-Covid, and the banks’ chances of recovering exposures.

Temporary measures put in place during the first wave of the virus often called for final exit strategies by the height of the second wave triggering extensions or further negotiated measures. Final settlements, discounted buyouts and refinancing of underwater facilities at a discount has since become more and more frequent. The aviation finance landscape has altered completely.

The re-emergence

2021 has so far seen a slow and steady move towards recovery for the aviation industry. Large domestic markets, such as the USA and China, are well on their paths to recovery with several domestic markets closing in on or surpassing pre-pandemic levels. International markets have also started to recover albeit at a far slower pace. By no means has the market recovered however, early signs of recovery have started to lead a ripple effect of improved market conditions. The aviation lender and investor community are starting to re-engage with airlines and originate transactions.

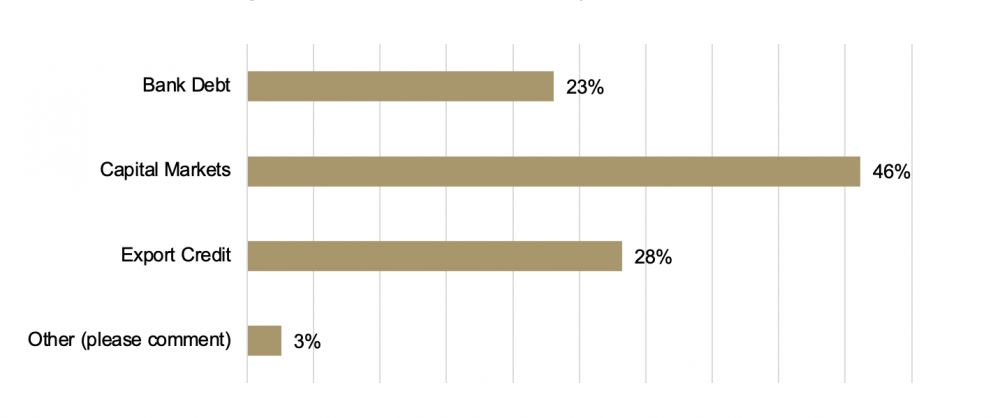

With capital starting to flow back in the industry, investors and lessors are seeking new transaction opportunities and the general tone of OEMs remains confident. Bank debt remains available largely for Tier 1 airlines and quality assets with debt funds and other alternative sources of financing providing some coverage to the rest of the market. As the market continues to recover, we expect to see better availability of debt finance with debt capital markets remaining strong. A healthy co-existence between the two along with the other alternative sources should make financing available for the broad spectrum of aviation investments in the post-Covid world.

Results from ACC Aviation’s most recent poll on “What source of funding will dominate aircraft finance post-Covid?” indicate that the market largely agrees with these trends.

What source of funding will dominate aircraft finance post-Covid?

To find out more or to discuss your requirements, get in touch with our advisory team +971 4 250 037 or email consulting@accaviation.com