This month, we take a closer look at what comprises an aircraft sale and leaseback (SLB) transaction, what makes it an attractive capital-raising avenue and what airlines need to take into consideration when making use of SLB.

It’s no secret that due to the ongoing COVID-19 pandemic, airlines around the world are experiencing unprecedented levels of liquidity challenges. The sharp decline in passenger demand has left airlines burning through cash reserves at an alarming rate and scrambling to raise the capital required to survive. Airlines with strong market positions and high credit quality have found themselves in a relatively advantageous position in terms of raising capital through government support, secured lending and other means.

Other airlines, however – typically smaller airlines and those that had challenging financial performances prior to the pandemic – have not had the same level of access and have struggled to meet their financial obligations.

Since the onset of the pandemic, airlines have sought to tackle liquidity issues by leveraging unencumbered assets to raise the capital necessary to help them get through the downturn. One avenue in particular has gained traction among airlines that own assets and are looking to raise additional capital: a sale and leaseback.

WHAT IS A SALE AND LEASEBACK?

SLB transactions are an effective way for airlines to unlock capital that is otherwise locked up as equity in, for example, an aircraft or other asset.

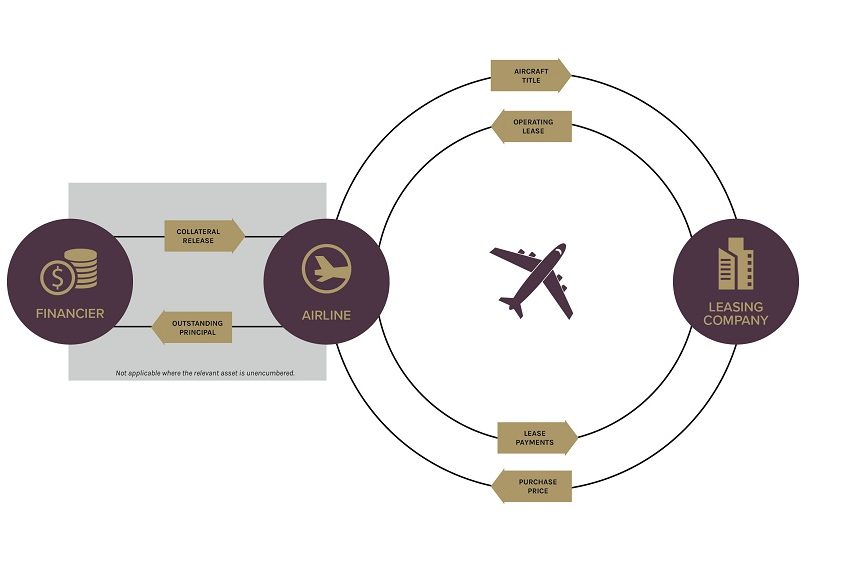

A simplified SLB transaction has two key elements:

- Firstly, the airline sells the selected asset(s) to a leasing company. This most typically applies to a whole aircraft or engines, but may also include spares, tooling or other tangible assets.

- Secondly, at the time of closing the sale transaction, the airline receives the sale price of the asset(s) and simultaneously enters into a lease agreement to lease back the same asset(s) from the lessor.

This practice allows airlines to unlock cash (representing the airline’s equity in the metal) while still being able to use the asset in its operations.

Figure 1: A diagram of a typical SLB transaction for a financed aircraft.

Given the economic impact that airlines have been subjected to in the current environment, SLB transactions represent a comparatively cheap and easy way for an airline to quickly bolster its cash reserves.

NOTEWORTHY TRANSACTIONS

- In April 2020, Delta Air Lines entered into a sale and leaseback transaction that released US$1 billion in cash. The airline entered two separate SLB agreements with BBAM Aircraft Leasing & Management and Altavair AirFinance, raising US$750 million and US$250 million, respectively.

- easyJet reported that it unlocked US$266 million in cash through an agreement with Bocomm Leasing in August 2020. In total, easyJet has so far raised US$804 million through SLB transactions, mainly through its fleet of A320 family aircraft.

- Cathay Pacific raised approximately US$704 million in a sale and leaseback transaction with BOC Aviation, involving six Boeing 777-300ER aircraft, at the onset of the pandemic.

When considering a SLB transaction, airlines need to consider the likely selling price or current market value of the assets against any underlying debt obligations, as this determines the equity, or actual cash, that can be unlocked.

Additionally, airlines should take into consideration the book value of their assets, because even though they may be able to unlock cash through a SLB, they are likely to realise significant book losses given the drop in aircraft current market values against typical aircraft depreciation policies.

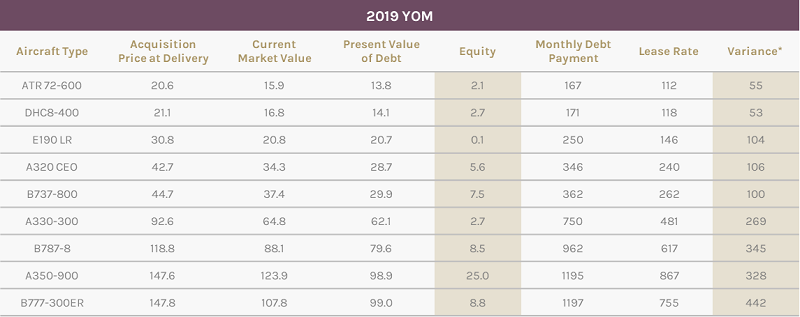

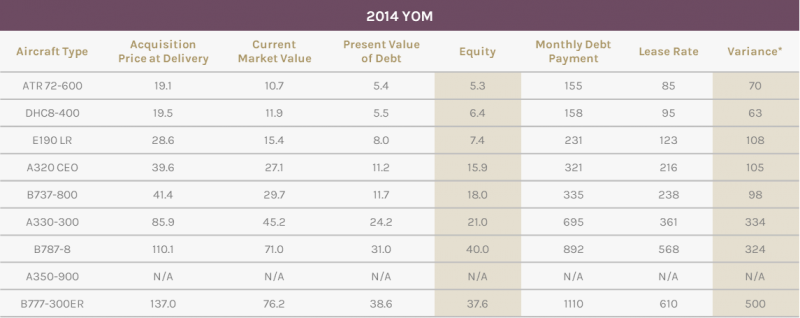

The following tables summarise the potential equity that can be unlocked from various aircraft types under current market circumstances as well as changes to airlines’ monthly cash flow profiles.

Table 1: SLB Analysis on 2-year-old aircraft

*Variance between the Lease Rate and Monthly Debt Payment

Table 2: SLB Analysis on 7-year-old aircraft

* Variance between the Lease Rate and Monthly Debt Payment

Assumptions

Debt Financing Ratio – 80%

Interest Rate (p.a.) – 4%

Debt Tenure – 10 years

Aircraft are January build month

Current Market Values represent ACC’s opinion as of the date of publishing

WHAT ARE THE BENEFITS OF A SALE AND LEASEBACK?

The primary benefits of a sale and leaseback for airlines are the ability to unlock immediate cash from their aircraft assets, shoring up liquidity, as well as in reducing their monthly aircraft financing related cash flow obligations.

Unlocking Equity from the Aircraft

Under typical financing assumptions, most airlines will be able to unlock equity in their aircraft through an SLB transaction bringing much needed liquidity to their balance sheets.

The magnitude of such cash release is relatively larger for aircraft that are further through their lending tenure than those that are at the beginning, simply because a typical loan amortisation profile over that period will ordinarily exceed any parallel decline in aircraft values.

In almost all cases, under the above financing assumptions, we’d expect current market values to be at a level that can sustain some level of cash release through a SLB transaction.

For newer year of manufacture units with higher use of leverage, there may be very little equity remaining in the aircraft, such that the SLB is not viable.

Our modelling suggests that under typical assumptions, 2016 vintages and older will recover at least their initial equity, and 2017 vintages and newer will recover less than their initial equity.

This of course will vary across aircraft types as well as associated financing.

Reducing Monthly Cash Flow Obligations

In addition to immediate upfront cashflow, airlines are able to reduce their monthly aircraft related financing obligations because current market lease rentals are lower than debt payment obligations tied to the original purchase of the aircraft.

Other Considerations for Aircraft Sale and Leaseback

Although SLB provides immediate cash flow benefits – both in terms of upfront cash release and lower monthly financing obligations – the longer-term impact of a sale and leaseback is less optimal than maintaining existing financing.

However, given the current market situation and airlines’ requirements to raise capital, airlines must consider all potential options, and SLB is an important source of additional capital.

Outside of the quantity of cash that can be unlocked, airlines need to be conscious of key leasing parameters such as maintenance reserves or redelivery compensation, lessor maintenance contributions, as well as aircraft redelivery conditions.

These are not typical features of debt financing arrangements.

In a similar vein, to the extent an airline has an existing lease with a lessor for another aircraft, there are clear efficiencies (and reductions in execution risk) to leverage off that relationship and form.

That said, a lease that has been entered into before February 2020 may not necessarily reflect in all instances commercial terms that a lessor is willing to provide in today’s climate.

Examples of areas where a lessor may reasonably want increased flexibility include transfer rights to the extent the lessor itself is having to manage a more challenging financing and/or back leveraging environment.

Finally, in some instances, a sale and leaseback transaction could potentially constitute one ingredient in a successful wider lease restructuring package.

There are clearly many other dynamics at play in the lease restructuring context, but it’s one example of how to help move the discussion away from what can often be seen as a zero-sum game.

IS A SALE AND LEASEBACK THE RIGHT FIT FOR YOUR NEEDS?

At ACC Aviation, we fully recognise the difficulties that airlines are facing globally in terms of cash flow and liquidity.

We are here to support operators that are looking to raise additional capital, either through sale and leaseback arrangements or exploring external avenues for secured financing.

There are a variety of avenues through which capital can be raised, each with its own advantages and disadvantages.

We help airlines understand the various options available to them, support the airline in identifying sources of capital, run valuations of aircraft, slots and other assets as potential collateral, and support airlines in managing the capital raising process – giving our advice throughout the process.

Our strategic consulting and asset management services are aimed at enabling airlines to withstand the challenges brought on by the current pandemic, capitalising on their core strengths and transforming them into entities that remain sustainable and add stakeholder value.

For more information about our complete range of services or to enquire about your airline’s specific requirements, get in touch or speak with a member of our team at +971 4 250 0373.

ACC Aviation can also put you in touch with legal counsel, which can answer legal questions specific to your organisation’s particular situation and goals.

Disclaimer: All values contained in this report are illustrative only and reflect our best judgment based on the information available to us at the time of preparation. ACC Aviation accepts no liability for any action taken or not taken as a result of the figures contained in this report.