A crucial element of a successful and mutually-beneficial aircraft transaction relationship is achieving an optimum financing arrangement with acceptable risk for each transacting party. This balanced approach creates a foundation for optimised and predictable returns for all parties.

This report will explore everything to consider to achieve a well-balanced and efficient transaction.

Aircraft financing structures create the transactional relationship between the users of the aircraft (airlines) and the different financing parties (lessors, lenders, investors) that are assuming the exposure in exchange for an expected return. In structuring any aircraft leasing or financing deal, the goal is to distribute the risks and rewards per the appetite of the transacting parties.

Depending on the type of financing, the list of transacting parties may involve the lessee, lessor, senior and junior financiers, secured and unsecured lenders, equity and preferred equity investors, and insurers and guarantors.

Over the past decades, the leasing, lending and legal community, along with insurers and regulators, have designed structures suitable to execute a broad range of aviation investments and trades, from plain vanilla unsecured loans and operating leases to highly-structured capital market products.

RISKS

On the risk side, the three primary considerations are the asset, the credit and the jurisdiction.

Credit risk typically refers to the lesee’s credit or the lessee and the lessor’s credit in some structures and encapsulates their operational and financial performance, market positioning and outlook. The overall credit strength is a good indicator of a borrower’s capability of keeping up with debt servicing, and it is factored into the financing facility.

Asset risk refers to the financed aviation asset in an asset-backed transaction, i.e. the physical collateral. The aircraft’s or engine’s market acceptance, positioning and outlook drive assumptions regarding the residual value, which is a significant component of most asset-backed deals. The residual value, i.e. the remaining value of the asset at the end of the financing term, can be a major contributor of overall rewards achievable in an aviation finance deal.

The third major consideration is the relevant jurisdiction of the deal. Jurisdictional risks are defined by macro-economical and political risks, the insolvency, repossession and enforcement regime of the jurisdiction, all of which can greatly affect the recovery rate and returns in case of a default scenario.

REWARDS

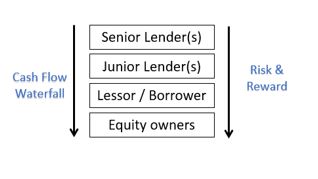

The reward side of the equation concerns the returns expected and achievable by each transacting party.

Airlines expect to generate operating cash flows above the cost of acquiring the aircraft: lease payments if lease finance, debt service payments if direct borrowing.

Lessors expect to generate cash flows from the leasing out and remarketing of the asset over their capital cost. Specialist lessors may generate back-end profit from creative end-of-life strategies involving the tearing down or conversion of the asset rather than an outright sale.

Lenders generate a return in the form of debt service, defined through the financing terms: tenor, loan to value, amortisation profile, financial covenants, guarantees, additional collateral, cross-default and cross-collateralisation, currency test, loan-to-value test (LTV) and debt service coverage ratio (DSCR) tests, and pricing.

Investors enter aviation finance deals with a return expectation to be met through cash flows available at different stages of the agreement per the seniority ranking between the parties.

Insurers assume risks associated with different events in return for policy premiums paid by the policyholder. In the case of a covered event, the distribution of the benefits is pre-defined by structuring the loan through assignments. The risk assumed by insurers is limited through agreed values, limits and caps.

STRUCTURING

A common feature of aviation finance deal structures is to put in place all necessary and available measures to maximise each party’s chances of generating the required returns while minimising the chances of capital loss. This is achieved through the use of a varied structuring toolset involving Special Purpose Vehicles (SPV), insurances and a comprehensive security package.

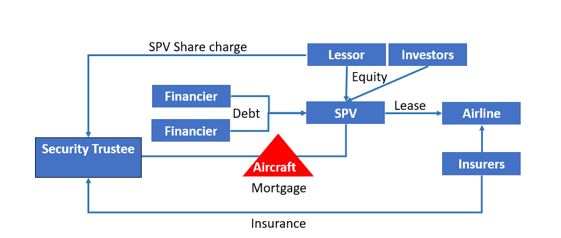

An SPV is a company established to acquire, finance, and lease specific aircraft and is typically incorporated in a tax-neutral/friendly jurisdiction. SPV-owned assets offer dual enforcement options for the financiers: against the asset (mortgage) and against the SPV through the share charge. Being a bankruptcy-remote entity/asset owner, the SPV is ring-fenced from other creditors’ claims and limits the financier’s ownership liability. An SPV is generally owned by the customer (airline or lessor) but can also be owned by an independent charitable trust or, in some cases, the bank. The liabilities of the SPV’s directors and equity sponsors are limited through limited recourse provisions.

Aviation insurances provide coverage for hull losses and liability for passenger injuries and environmental and third-party damage caused by aircraft accidents. International and national regulators set a minimum standard of insurances required to maintain airworthiness. The transaction documents in an aircraft finance/leasing deal define the types of insurances required, the parties liable for taking out the policies and the beneficiaries.

A security interest on a loan is a legal claim on collateral that the borrower provides that allows the lender to repossess the collateral and sell it in case of an event of default. The security package is a collection of legal documents establishing the security interest, such as first priority English or New York Law mortgage, first priority local law mortgage, registration of the security interests on the International Registry, IDERA and/or de-registration power of attorney, charge over the shares of the SPV, charge over the accounts of the SPV, assignment of the rights and benefits under the lease, original equipment manufacturer (OEM) warranties and insurance, assignment of engine servicing support agreement, guarantees, emission trading system (ETS), Eurocontrol and other liens letters, and letter of recognition of rights.

Through the combined use of the above tools, a well-structured aircraft financing deal should maintain the desired risk & reward profile of the parties involved through the term of the financing from drawing to repayment and in any eventuality caused by external circumstances in between.

To find out how ACC can help you achieve well-balanced and efficient transaction, please visit our dedicated pages for investors, lenders, lessors and operators here. Alternatively, please send us an online enquiry, our team is always happy to provide an independent advice.