The COVID-19 crisis has had a significant impact on the airline industry and the aviation sector at large.

Not many would have envisioned the extent of its impact back in January 2020, when the WHO was first notified of the coronavirus outbreak in China. What ensued was a rapid spread of the virus around the globe and by March, most governments had implemented significant containment measures to limit the spread.

Unrestricted air travel was the primary target of many government responses. And, as a direct result, global passenger demand fell to unprecedented levels, expected to be down 66% this year in comparison to 2019. The financial impact on airlines amounted to a gross revenue loss of USD 139-179 billion in the first half of 2020 alone.

For the year, airlines are expected to incur net losses of USD 84.3 billion with a net profit margin of -20.1% – the worst year on record.

A shift in consumer sentiment, extended travel restrictions and the ensuing economic crisis are likely to keep passenger demand at levels below pre-COVID for months to come. Airlines must realign their business strategies with the needs of the market in the short to medium term, and safeguard the viability of their businesses in the long term.

We comment on the strategies that airlines can implement to address the current oversupply of capacity in their markets, look at ways to unlock capital and address problems related to managing cash flow.

KEY TRENDS AND MARKET IMPACT

Government restrictions, travellers’ loss of confidence and the ensuing economic crisis resulted in a sharp decline of air travel demand. This consequently impacted global capacity levels, as airlines were forced to park their aircraft.

Capacity in the Asia-Pacific region was the first to be impacted, owing to the proximity of the region to the initial source of the pandemic. The Asia-Pacific region saw a sharp decline in ASK levels in February; the rest of the world followed suit in March.

At the peak of the crisis, capacity was down by more than 90% in most parts of the world (except for the Asia-Pacific region, where it fell by approximately 75%).

Much of the impact on global capacity levels was seen early on, when travel restrictions were at their highest – and as governments eased travel restrictions in the following months, the road to recovery was paved for airlines. The largest domestic markets in the world, China and the US, showed considerable resilience throughout the summer period, reaching capacity levels at the end of summer of around 65% of those achieved at same time last year.

Capacity levels in Europe also saw a significant uptick between July and September – but reversed following the emergence of a second wave of infections.

Africa, the Middle East and Latin America have been hit the hardest in terms of total and prolonged capacity reductions, due to the absence of a significant domestic air travel market.

IMPACT ON AIRLINES

IATA’s current COVID-19 Travel Regulations Map shows that travel restrictions remain in place for nearly 85% of the globe (186 out of 220 countries), including in Africa, where travel restrictions apply to 80% of the continent (43 out of 54 countries).

In Africa specifically, RPKs were down by 87.4% year on year, with airlines achieving average load factors of just 39% in August. Global ASKs have dropped by 55.3% year-to-date, with airlines finding themselves in possession of surplus capacity.

Airlines are expected to post record losses in 2020, in excess of USD 84 billion – making it the worst financial year in commercial aviation history.

One of the primary factors driving losses is that approximately 50% of an airline’s cost base is fixed or semi-fixed, at least in the short-term – making it extremely challenging to cut costs and scale down operations at the same pace as the fall in passenger demand.

The economic impact of the pandemic is likely to keep demand levels below pre-COVID times for months to come and as such, airlines need to proactively align their fleet strategies with the capacity needs in the short to medium term, as well the long term.

The ongoing slump in passenger demand and the surplus capacity in the market necessitates a strong need for action. From the network and fleet perspective, airlines should forecast passenger demands and capacity levels over time and scale their operations accordingly. They’ll need to have sufficient access to capital to remain solvent throughout the crisis – with diversified revenue streams and strategies.

PREDICTING THE FUTURE

Uncertainty surrounds the recovery period for passenger demand, but several scenarios have been forecasted by trade groups and economists. ICAO predicts that passenger demand may follow one of the following recovery scenarios:

- V-shaped recovery: the economy experiences a sharp decline but bounces back quickly to its previous peak

- U-shaped recovery: the economy experiences a sharp decline, but the recovery undergoes a period of stagnation before rising to healthy levels

- W-shaped recovery: the economy experiences a sharp decline followed by a momentary rapid recovery. This is followed by another sharp decline which ultimately paves way for a real recovery to healthy levels

- L-shaped recovery: the economy experiences a sharp decline followed by an extremely prolonged recovery period

- “Nike-swoosh” recovery: the economy experiences a sharp decline, but momentarily bounces back quickly followed by a prolonged recovery period

Despite uncertainty in the market’s recovery, it is imperative that forward planning is undertaken. Airlines need to scale down in the short term, while being appropriately equipped to grow with passenger demand.

ROAD TO RECOVERY

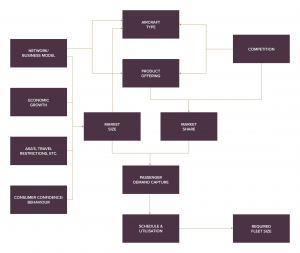

There are some key considerations that airlines must assess while predicting the recovery trends within their respective markets. These considerations will assist airlines in creating a workflow that can help project passenger demand, and the required network and fleet that is needed to serve capacity requirements.

Firstly, airlines must consider how long the pandemic may last and its impact on passenger demand in the long term. Owing to breakthroughs in the discovery and roll out of COVID-19 vaccines, some regions may recover from this pandemic sooner than others depending on availability. Projecting vaccine distribution and easing travel restrictions will help airlines assess which markets may recover sooner, and the extent to which demand will return to pre-COVID levels.

Air travel restrictions are easing in some areas and airlines are starting to gradually fill the market with capacity – but airlines must assess the impact this will have on passenger sentiment; will passengers be incentivised to start travelling or will they wait for the vaccine?

What impact will this have on current and future consumer behaviour? Will the industry experience a structural shift to address these changes?

Airlines must consider the trend of recovery that the economy may follow. Economic recovery rates may differ depending on the size, geographical position and the prevailing consumer sentiments in a market. As an example, the average global sentiment pertaining to the shape of the economic recovery is U-shaped. However, the recovery sentiment in some regions (such as Japan and the Gulf) is more aligned towards an L-shaped recovery.

It is also important to take into consideration and actively gauge the extent to which the air transport industry can withstand the financial impact of the ongoing pandemic, so that airlines can understand what level of capital will be required to run a sustainable operation.

Below is a general workflow diagram for projecting passenger demand, and the required network and fleet to support it; this workflow is applicable across time and across individual routes.

N.B. This diagram is illustrative in nature and not representative of all considerations

SCENARIO FORECASTING

The factors affecting economic and passenger demand vary based on a range of factors, including geographic location, composition of regional and international markets, target passenger segments and market competition. No two airlines or markets will exhibit the same recovery characteristics – and therefore it is necessary that airlines run their own recovery scenarios, to more accurately forecast their network and fleet requirement.

To illustrate some of the considerations an airline should be taking towards their future fleet plans, we have conducted a high-level modelling exercise using the ICAO recovery scenarios. This exercise is based on a hypothetical airline under the following assumptions:

- Single type fleet comprising of 10 aircraft

- Average daily utilisation of 7.9 block hours per aircraft per day under normal market conditions

n.b. This scenario utilises ICAO scenario projections for Africa as whole. Airlines should assess their own situations individually as demand factors will vary from market to market and from airline to airline.

Utilisation (Total Fleet)

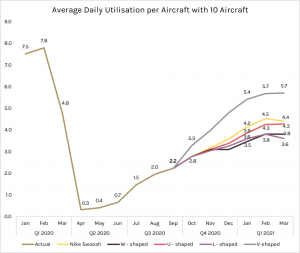

The following graph illustrates the impact of the ongoing pandemic on the total utilisation levels (block hours) of a hypothetical airline, as well as the continued impact projected through Q1 of 2021.

Fig. 1: Monthly Fleet Utilisation with 10 Aircraft

It is important to note that the V-shaped recovery (grey) represents the latest published schedules by airlines. It is an information-only scenario that reflects airlines’ most recent expectations – a sign of airlines’ plans, which may not necessarily be realistic (ICAO).

Utilisation (per Aircraft)

The following image translates total fleet utilisation into a per aircraft basis. The daily average utilisation per aircraft of a 10-aircraft fleet declined significantly – from 7.9 block hours per aircraft per day at the start of the year to a low of 0.3 hours in April, up to 2.2 hours at the end of Q3, as seen in the graph below (Figure 2).

Fig. 2: Average Daily Aircraft Utilisation

As the market recovers over the projected period, average daily utilisation per aircraft remains below 5 block hours under all recovery scenarios, which is suboptimal. The low level of daily aircraft utilisation confirms the presence of surplus equipment in the fleet – and the disparity between projected passenger demand and the capacity needed to service it must be addressed.

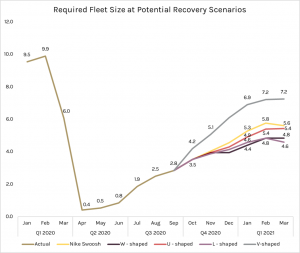

Required Fleet Size

The trends presented in the average daily utilisation graph (Figure 2) have a direct impact on the fleet size of the hypothetical 10-aircraft airline. The required fleet size of this airline, as per the Potential Recovery Scenarios below (Figure 3), only reaches 5 aircraft by Q1 of 2021, based on the optimal level of utilisation that is expected per aircraft (V-shaped recovery is based on published schedules, not reality).

Fig. 3: Required Fleet Size at Potential Recovery Scenarios

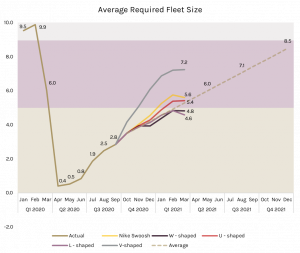

Projected Required Fleet Size

Using the projections in Figures 1, 2 and 3, the future fleet requirement post-Q1 2020 can be forecasted as seen below (Figure 4). For the sake of simplicity and demonstration, we have used a simple linear trend line to extend market recovery. In reality, this projection would be a separate exercise in itself.

Figure 4: Average Required Fleet Size

We distribute the 10-aircraft fleet in three classifications:

- Core fleet – shaded in gold in the graph above

- Supplementary fleet – shaded in purple

- Redundant fleet – shaded in grey

In terms of projections through Q1 of 2020, 5 out of the 10 aircraft will be required for the airline to maintain its core network. These 5 aircraft are classified as the core fleet. Under this scenario, it is projected that by Q4 of 2021, the airline may require an additional 4 aircraft to support demand recovery.

But the requirement for these units is subject to an element of uncertainty, as the market recovery is still a forecast; so we classify these 4 aircraft as supplementary.

The remaining aircraft is likely not required within the next 12 months (or longer), and is classified as a redundant aircraft. Placing the existing fleet within these three categories can help drive decisions on future fleet strategy.

SCALING THE BUSINESS

Given the economic crisis imposed on the airline industry by the pandemic, airlines must consider all options to ensure long-term viability. Scaling the business in line with current and future market projections has become a necessity as a result of the economic loss airlines have realised – and will continue to realise as a result of surplus equipment.

When scaling operations, airlines need to consider their core fleet, supplementary fleet and their redundant fleet.

Core Fleet

The core fleet is made up of aircraft required to perform core operations currently and in the future. The only strategy for a core fleet is retention – but airlines can use these assets to unlock additional capital and possibly convert a fixed cost base to a variable one, at least in the short term.

- Unencumbered aircraft and engines can unlock additional capital through refinancing or sale and leaseback

- Airlines that have aircraft on operating leases or other types of leases may try to renegotiate the terms of their contracts; for temporary lease rental deferrals or power-by-the hour agreements

Supplementary Fleet

Supplementary aircraft are not required immediately but are expected to be required through the next 12 months of market recovery (subject to some uncertainty). Since these aircraft are not required currently, airlines can use strategies such as:

- Parking and preservation of the aircraft for use in the medium-term

- Offer aircraft on ad-hoc charter or into the ACMI market

- Place the aircraft on a medium-term sub-lease

Airlines will find options 2 and 3 the most challenging due to the oversupply of capacity globally. However, as the market is slowly on track to recovery, there may be some opportunities for airlines to monetise their assets via charter, ACMI or sub-lease arrangements.

The supplementary fleet can also raise capital via refinancing or sale and leaseback. Airlines can soften their operating cost base through the renegotiation or deferral of lease rentals or temporary power-by-the-hour arrangements.

Redundant Fleet

These aircraft will likely not be required for the medium-term as a result of prolonged market recovery. Airlines can consider the following options to address this:

- Preservation and storage

- Outright disposal, part-out or scrap of the aircraft (where owned)

- Returning aircraft to lessors at the end of the lease term or negotiation of early lease return (where leased)

- Repurpose these aircraft for freighter operations

The viability of each option and the determination of the most optimal exit strategy is subject to many variables and requires an individual approach to each asset. Most exit decisions are driven by aircraft type, maintenance utility and market appetite for the specific aircraft.

RETHINKING SUPPORT

This article is written in follow up to the AFRAA 52nd AGA, where this information was presented virtually. The video of the presentation can be found here.

As part of initiatives for the aviation industry to recover from the impact of the COVID-19 pandemic, the African Airlines Association (AFRAA) and ACC Aviation have launched an interactive portal for AFRAA member airlines, under their “AFRAA – Powered by ACC” strategic partnership.

This partnership aims to realise a sustainable, interconnected and affordable air transport industry in Africa – providing airlines with access to market-leading services to support the development of Africa’s aviation industry.

The strategic partnership provides a platform for raising the profile of African airlines globally, effectively maximising their fleet utilisation and delivering a range of consultancy services designed to help them improve organisational resilience and respond even more effectively to global market opportunities.

For more information about our complete range of services or to enquire about your airline’s specific requirements, get in touch or call to speak with a member of our team on +971 4 250 0373.