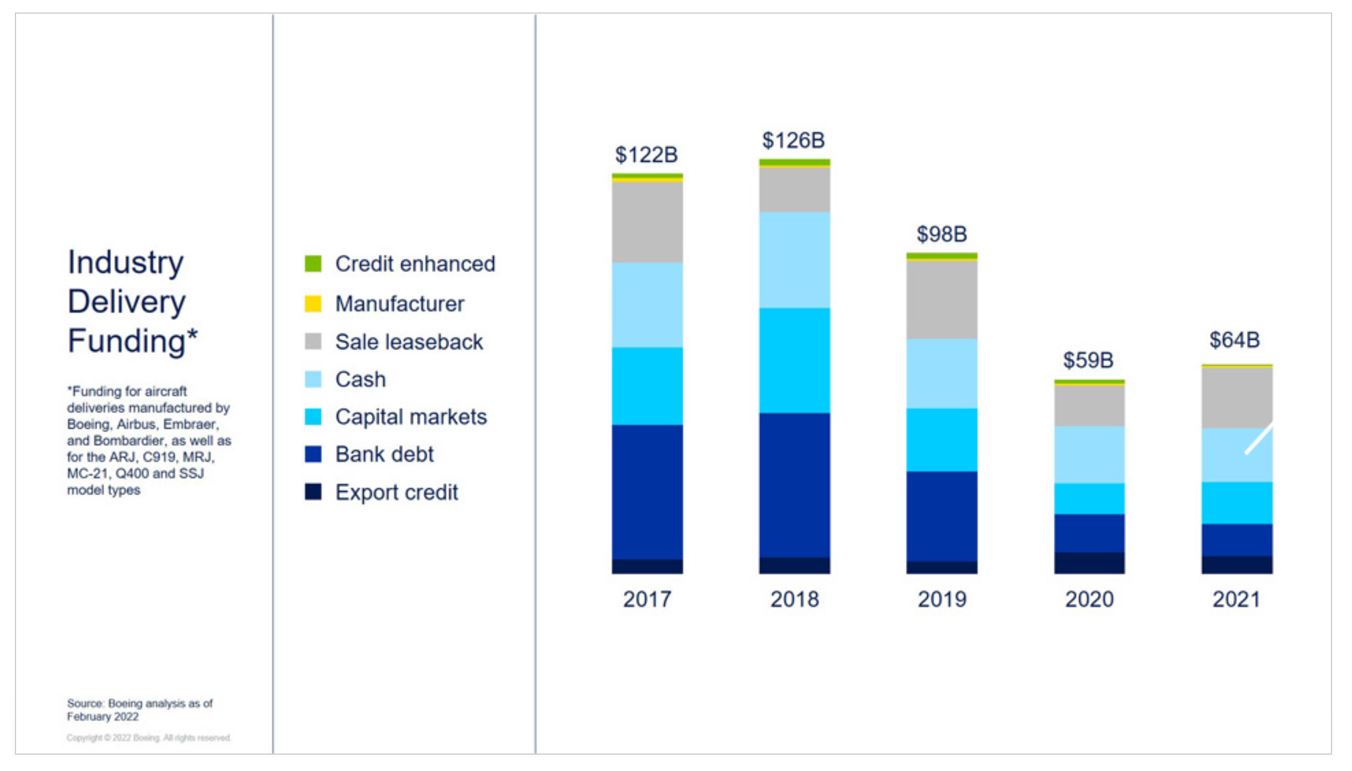

Aviation continues to be a robust industry poised for continued recovery and growth following the interruption caused by the Covid pandemic and Russia’s invasion of Ukraine. Along with the industry it supports, aviation finance continues to show a strong trend of recovery providing sufficient liquidity to support new aircraft deliveries and the general growth and modernization of the global aircraft fleet.

The main sources of aviation financing globally include Leasing, Institutional Funds, Capital Markets, Tax Equity, Commercial Banks, Credit Enhanced Products, Export Credit Agencies and OEMs. The significance and relative contribution of each source may change over time in line with the market realities and practicalities of the financing products offered.

Aircraft lessors

Aircraft lessors have been playing an increasingly significant role in the industry, a continued growth that has been exacerbated by the pandemic, during which lessors were responsible for over half of the global delivery financing volumes, while they continued to provide their airline clients with critical capital through Sales and Leaseback transactions as well. The current total leased fleet amounts to roughly half of the global fleet, making the Leasing sector a key source of aviation financing.

Capital Markets

Capital Markets have immensely supported the industry through the past years through the purchase of debt products (bonds and notes) issued by both airlines and lessors. The volume of issuances has nearly tripled between 2012 and 2021 ($43bn to $122bn) and, in a generally low funding cost and rates environment, has been proven to be a popular product. With the current trends of rising interest rates, this source of funding for airlines and lessors may see a decline in favour of other sources of funding.

Commercial Banks

Debt financing can take several shapes, such as loans secured over the financed aircraft extended, either directly to aircraft operators or lessors, finance leases, as well as unsecured liquidity facilities. This source of funding for the aviation market has been constrained during the pandemic with commercial banks mainly focusing on Tier 1 operators and new generation assets. However, there are clear signs pointing to the improving availability of bank debt for the sector.

Export Credit Agencies

Export Credit Agencies (ECA) play a significant role in aircraft financing, particularly when dealing with more exotic assets, credits and/or jurisdictions. In return for a premium, these agencies guarantee the financing provided by commercial banks, effectively replacing the borrower’s credit rating with that of the ECA (sovereign or private). ECAs of the Original Equipment Manufacturers’ countries, such as Coface in France (for Airbus), Export-Import Bank of the United States (Boeing), Export Development Canada (EDC) and BNDES in Brazil (Embraer), as well as private insurance products such as AFIC and Balthazar, provide added security to financing assets in Africa making aircraft financing deals economically viable. This type of aviation asset financing also tends to gain further significance during challenging times for the aviation market at large. ECAs currently amount to around 9% of the funding of the aviation industry.

Institutional Investors and Funds

The pandemic has provided institutional investors, funds and alternative asset managers with an opportunity to expand their aviation exposure at their, generally higher, targeted return levels. Distressed owners and operators offered discounted asset purchase opportunities to these platforms, being able to deploy capital where traditional sources of financing became unavailable.

Tax Equity

Particularly popular in Japan and certain other jurisdictions, products such as Japanese Operating Lease (JOL) and Japanese Operating Leasing with Call Option (JOLCO) offer investment opportunities to tax equity investors to finance the aviation industry. This class of investors remain cautious following the recent disruptions and a recovery in significance is expected, similarly to commercial debt, initially focused on Tier 1 credit airlines

Credit Enhanced

With the aviation industry being a vital part of national economies, enabling trade, mobility, supporting supply chains as well as the export-focused industries, governments may extend sovereign guarantees to support the financing of aircraft purchased by local airlines, acting as credit enhancement. These credit enhanced facilities have been gaining popularity for years in certain regions, such as Africa, and can provide for a significant portion of the continent’s aviation finance arrangements.

Aircraft and Engine Manufacturers (OEMs)

Original equipment manufacturers (OEMs) typically offer expert advice on financing solutions to their customers with certain manufacturers providing direct financing as well. Boeing Capital Corporation, Airbus Bank, and Embraer’s recently signed $180m syndicated facility all provide a significant source of funding to the industry.

With over 20 years of industry knowledge, ACC Aviation provides impartial advice and acts as a trusted advisor to aviation stakeholders worldwide. We support airlines in structuring and raising capital to finance their fleet growth plans, and support aviation lenders and lessors in monitoring and managing their investments.

To find out more or to discuss your requirements, get in touch with our advisory team +971 4 250 037 or email consulting@accaviation.com